Further Explanation:Other Precautions in the Customs Declaration Process for Imported Clothing Transportation

Successfully completing the customs declaration process for imported clothing involves more than just filling out the correct forms and paying tariffs and taxes. Several preventive measures must be taken to ensure a smooth process from the initial documents to the final release of the goods. This article takes you to understand other precautions for transporting imported clothing

Accurate Product Description

Importance

Accurate descriptions of the goods are critical for correct classification and valuation. Misdescriptions can lead to incorrect duties and taxes being paid, resulting in potential penalties or delays.

Precautions

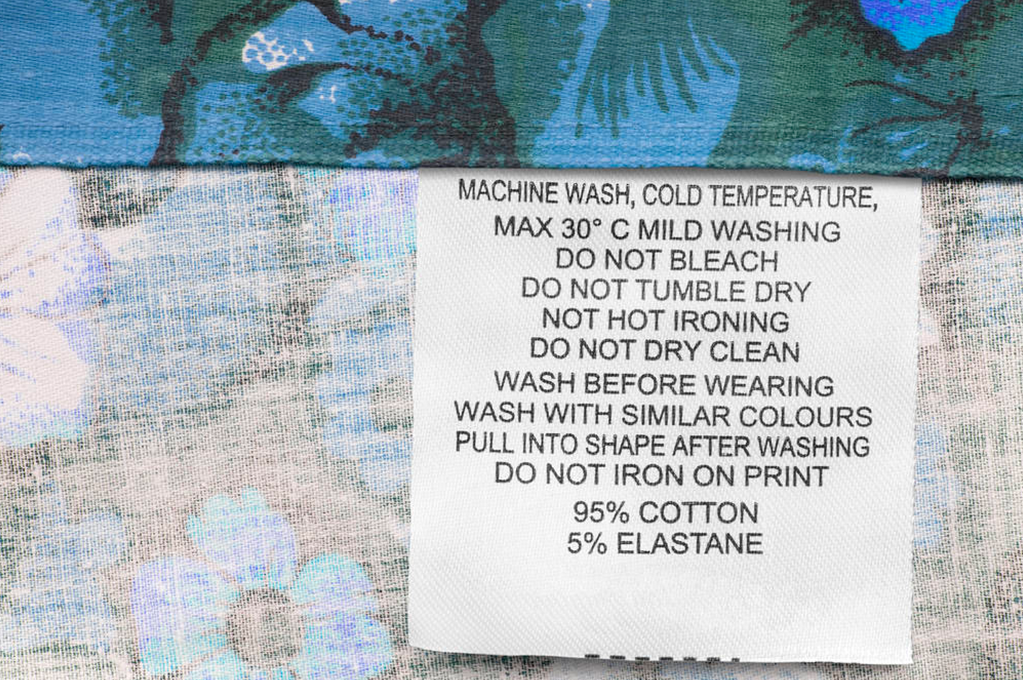

- Detail Specifications: Ensure that the product description includes specific details such as material composition, manufacturing process, intended use, and any brand names. For example, if the clothing item is a cotton t-shirt, specify the percentage of cotton, any blended fibers, and any special treatments applied during manufacturing.

- Consultation: When in doubt, consult with customs officials or a customs broker to verify the accuracy of the product description. Brokers can provide expert advice on the correct terminology and ensure that the description aligns with the appropriate HS codes.

Labeling Requirements

Importance

Labeling requirements vary by country and can affect the admissibility of the goods. Incorrect or missing labels can cause delays and may lead to fines.

Precautions

- Country-Specific Regulations: Research and comply with the specific labeling regulations of the importing country. For instance, the European Union may require that clothing labels indicate the country of origin, fiber content, and care instructions in a specific format and language. Ensure that all required languages are included on the labels if the importing country mandates multilingual labeling.

- Consistency Across Documents: Ensure that the labels on the goods match the descriptions in the commercial invoice and other shipping documents. Consistency is key to avoiding discrepancies that can trigger further scrutiny by customs officials.

Intellectual Property Rights

Importance

Respecting intellectual property rights (IPR) is crucial to avoid legal issues and to maintain brand integrity.

Precautions

- Trademark and Copyright Awareness: Verify that the clothing does not infringe on any trademarks, copyrights, or patents held by third parties. This includes checking that any logos, designs, or slogans printed on the clothing are either owned by the importer or authorized for use.

- Authorization Documents: Provide authorization documents if the clothing features logos or designs owned by others. This could include licensing agreements, letters of authorization, or any other documentation that proves the right to use protected intellectual property.

Environmental Compliance

Importance

Many countries have strict environmental regulations concerning the materials used in clothing and the manufacturing processes employed.

Precautions

- Chemical Restrictions: Check for any restrictions on chemicals used in dyes or treatments, as some substances may be banned or heavily regulated. For example, some countries prohibit the use of azo dyes due to health concerns.

- Sustainable Practices: Highlight any sustainable or eco-friendly practices used in production, as this can sometimes lead to preferential treatment or lower tariffs. Providing evidence of sustainable sourcing, such as organic cotton certification, can demonstrate compliance with environmental standards and may open doors to preferential trade agreements.

Trade Compliance

Importance

Trade compliance involves adhering to international trade laws and agreements, which can impact tariffs and duties.

Precautions

- Trade Agreements: Familiarize yourself with any free trade agreements (FTAs) that may apply to the importation of clothing from the exporting country. FTAs can significantly reduce or eliminate tariffs, making it beneficial to leverage these agreements.

- Sanctions Check: Ensure that the goods are not originating from sanctioned countries or entities that could lead to legal repercussions. Sanctioned countries may face embargoes or other restrictions that could block the entry of goods into the importing country.

Insurance and Risk Management

Importance

Insurance protects against financial losses due to damage, theft, or other unforeseen events during transit.

Precautions

- Comprehensive Coverage: Obtain comprehensive cargo insurance that covers all risks associated with the transportation of the goods. This includes coverage for damage, loss, and delays, ensuring that the financial impact of any incident is mitigated.

- Risk Assessment: Conduct a thorough risk assessment to identify potential threats and develop strategies to mitigate them. Understanding the risks associated with the transportation route, weather patterns, and geopolitical situations can help in tailoring the insurance policy to cover specific risks.

Communication and Coordination

Importance

Clear communication and coordination among all parties involved in the import process are vital to prevent misunderstandings and delays.

Precautions

- Regular Updates: Keep all stakeholders, including suppliers, logistics providers, and customs brokers, informed about the status of the shipment. Regular updates can help in anticipating any potential issues and addressing them proactively.

- Emergency Contacts: Have emergency contacts ready in case of unexpected issues, such as customs delays or logistical problems. Having a list of contacts for customs offices, shipping agents, and legal advisors can expedite problem resolution.

Contingency Planning

Importance

Having a contingency plan is essential to manage unforeseen circumstances that could disrupt the supply chain.

Precautions

Alternative Routes: Identify alternative routes or modes of transport that can be used if the original plan is compromised. For instance, if a particular sea route is experiencing disruptions due to piracy or natural disasters, having a backup air freight option can be crucial.

Backup Suppliers: Establish relationships with backup suppliers who can fulfill orders if the primary supplier experiences issues. Maintaining a network of trusted suppliers can help in ensuring continuous supply chain operations.

Documentation Retention

Importance

Maintaining records of all transactions and communications is crucial for compliance audits and future reference.

Precautions

- Systematic Filing: Organize all documents systematically and retain them for the required retention period. Typically, customs regulations stipulate a minimum retention period, often ranging from three to five years.

- Digital Copies: Keep digital copies of all documents to ensure they are accessible and secure. Digital archiving can make it easier to retrieve documents when needed and can protect against physical damage or loss.

The customs declaration process for imported clothing is multifaceted and requires attention to various details beyond the initial documentation phase. By taking the necessary precautions, such as ensuring accurate product descriptions, complying with labeling requirements, respecting intellectual property rights, adhering to environmental and trade regulations, securing proper insurance, maintaining clear communication, planning contingencies, and retaining thorough documentation, importers can mitigate risks and facilitate smoother customs clearance. Effective management of these elements not only ensures regulatory compliance but also contributes to the overall efficiency and reliability of the import process.

I hope this article can help you further understand Other Precautions in the Customs Declaration Process for Imported Clothing Transportation. If you want to learn more about importing clothing and transportation from China, you can visit our homepage or お問い合わせ directly!